Accounting Equation Examples

Journal entries often use the language of debits (DR) and credits (CR). A debit refers to an increase in an asset or a decrease in a liability or shareholders’ equity. A credit in contrast refers to a decrease in an asset or an increase in a liability or shareholders’ equity. It shows that assets owned by a company are coupled with claims by creditors and lenders (liabilities), and by the owners of the business (capital). Notice that every transaction results in an equal effect to assets and liabilities plus capital.

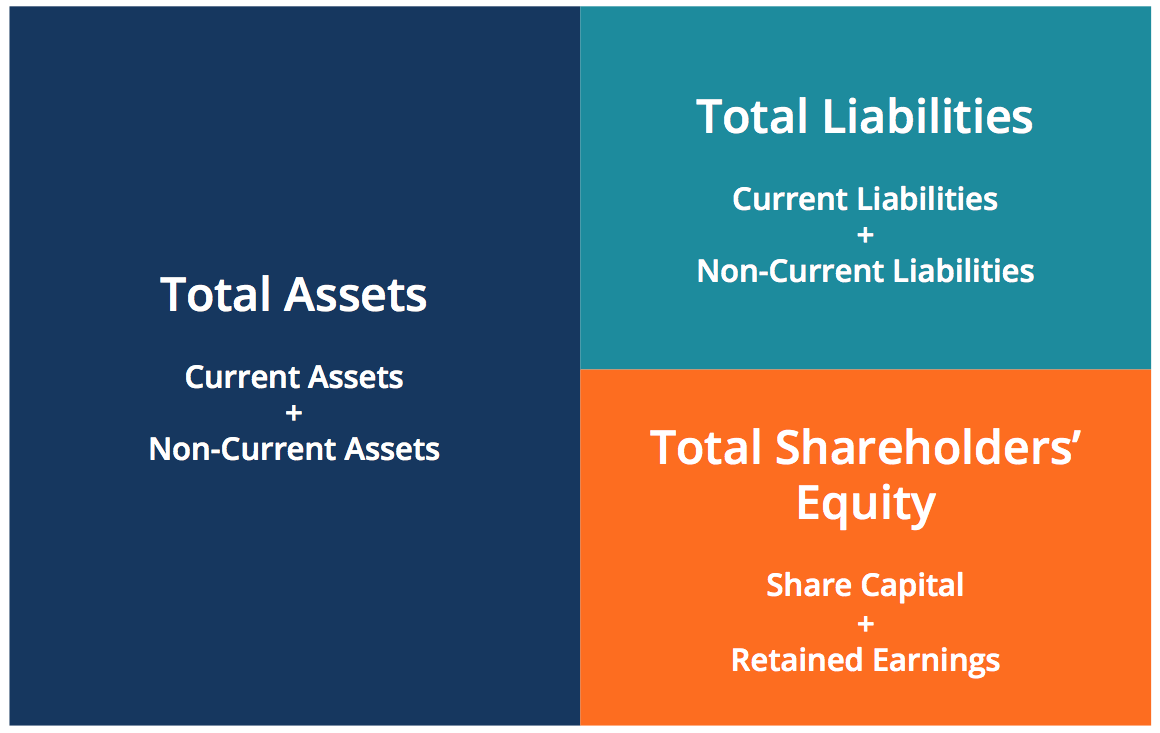

Accounting Equation Components

Liabilities and capital were not affected in transaction #3. To learn more about the income statement, see Income Statement Outline. For more insights into the accounting equation, consider enrolling in accounting courses or reading specialized literature. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Balance Sheet and Income Statement

At the same time, it incurred in an obligation to pay the bank. The liability in this case is recorded as Loans Payable. The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position.

Effects of Transactions on Accounting Equation

Does the stockholders’ equity total mean the business is worth $720,000? Because many assets are not reported at current value. For example, although the land cost $125,000, Edelweiss Corporation’s balance sheet does not report its current worth. Similarly, the business may have unrecorded resources, such as a trade secret or a brand name that allows it to earn extraordinary profits. Alternatively, Edelweiss may be facing business risks or pending litigation that could limit its value. Consideration should be given to these important non-financial statement valuation issues if contemplating purchasing an investment in Edelweiss stock.

What Are the Key Components in the Accounting Equation?

Current assets are resources that a company expects to convert into cash or use up within one year. Examples include cash, accounts receivable, and inventory. Long-term assets, on the other hand, are resources that a company expects to use for more than one year. The distinction between current and long-term assets is important for understanding a company’s liquidity and long-term financial health. Assets are going to be anything tangible or intangible that is owned by the company. So this is anything that they own and we’re going to break these up into 2 categories.

Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, square and xero & investment analysis topics, so students and professionals can learn and propel their careers. Equity represents the portion of company assets that shareholders or partners own.

This observation tells us that accounting statements are important in investment and credit decisions, but they are not the sole source of information for making investment and credit decisions. The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle.

The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets. The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is based on the idea that each transaction has an equal effect. It is used to transfer totals from books of prime entry into the nominal ledger.

Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Before taking this lesson, be sure to be familiar with the accounting elements. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Compare that with a long term liability which is payable in over 1 year, right?

- (Note that, as above, the adjustment to the inventory and cost of sales figures may be made at the year-end through an adjustment to the closing stock but has been illustrated below for completeness).

- An asset is a resource that is owned or controlled by the company to be used for future benefits.

- The elements of accounting pertain to assets, liabilities, and capital.

- So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance.

- We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation.

(Note that, as above, the adjustment to the inventory and cost of sales figures may be made at the year-end through an adjustment to the closing stock but has been illustrated below for completeness). A liability, in its simplest terms, is an amount of money owed to another person or organization. Said a different way, liabilities are creditors’ claims on company assets because this is the amount of assets creditors would own if the company liquidated. In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity.

Net income increases retained earnings, thereby increasing equity, while a net loss decreases retained earnings, thereby reducing equity. Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid. The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy.