Cost of Goods Sold: Defining & Calculating COGS

Product cost refers to the costs incurred in manufacturing a product intended to be sold to customers. These costs include the costs of direct labour, direct materials, and manufacturing overheads. During inflation, the FIFO method assumes a business’s least expensive products sell first. This process may result in a lower cost of goods sold calculation compared to the LIFO method.

Cost of sales vs cost of goods sold: What’s the difference?

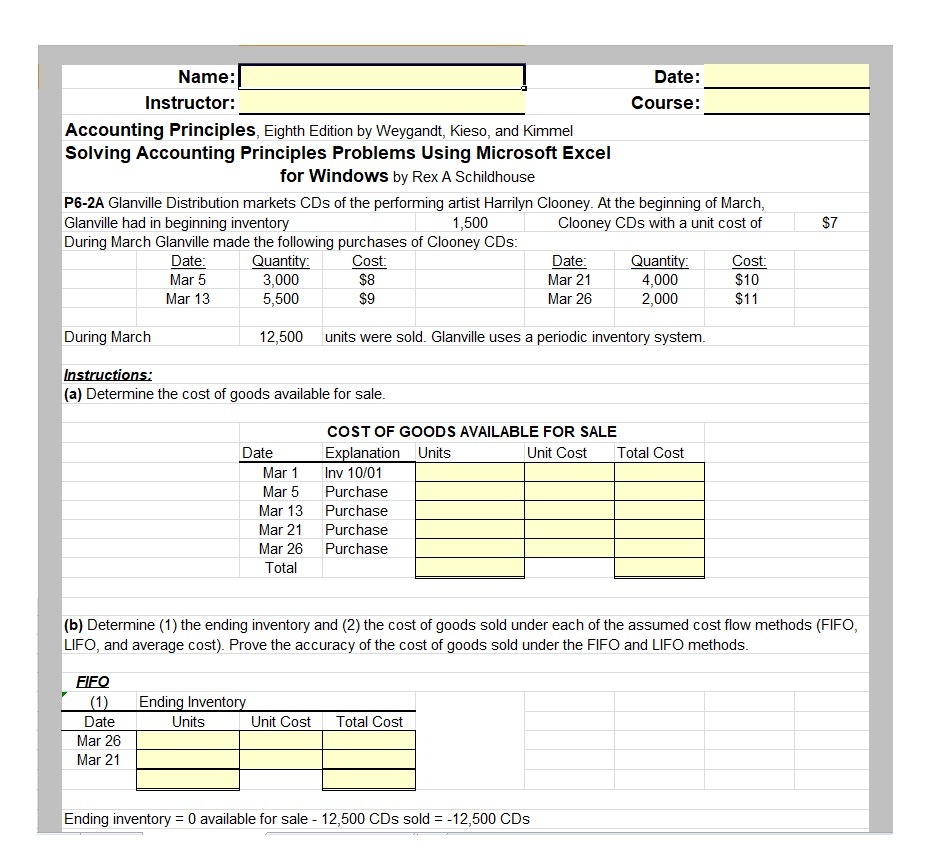

It is likely that during a given accounting period, your business might purchase inventory at several different prices. Since the inventories are purchased at different prices, the challenge that arises is to divide the cost of goods available for sale between the cost of goods sold and the ending inventory. The product cost helps you determine the selling price of your finished products and know whether your business has earned profits, incurred losses, or has achieved the break-even point. So, the cost of goods that are not yet sold but are ready for sale can be recorded as inventory (asset) in your balance sheet. However, as soon as such goods are sold, they become a part of the COGS and appear as an expense in your company’s income statement.

How confident are you in your long term financial plan?

The businesses that are into the business of selling the products can only list the cost of the goods sold on their statement of income. While calculating the cost of the goods sold, only the inventory sold during the current accounting period should be included. COGS includes only the direct costs of producing goods, such as raw materials and direct labor. This focus excludes indirect costs like overhead, administrative expenses, and marketing costs. While this provides clarity on the direct profitability of products, it omits significant expenses that can affect the overall profitability of the company. It should be taken as an expense while analyzing that accounting period.

The cost of goods sold formula

Companies that make and sell products or buy and resell goods must calculate COGS to write off the expense. The resulting information will have an impact on the business tax position. Inventory at the beginning of the calendar year, recorded on January 1st, 2018, is $11,000, and the Inventory at the end of the calendar year, recorded on December 31st, 2018, is $3,000. Calculate the cost of goods sold during the calendar year ending on December 31st, 2018. This method of inventory valuation is widely used as it is simple to use, and it is difficult to manipulate net income under this inventory pricing method.

How do you calculate the variable cost of goods sold?

The cost of the goods sold is matched with revenues earned from selling the goods, thereby considering the gross profit. The cost of the goods sold is matched with revenues earned from selling the goods, thereby considering the matching principle of the accounting. When the cost of the goods is subtracted from the total revenue, the results will be the gross profit.

- But, if your business maintains inventory records using a perpetual inventory method, the average cost is calculated using the moving average method.

- The choice of method can significantly impact COGS and, consequently, profitability and tax liabilities.

- The formula for calculating cost of goods sold (COGS) is the sum of the beginning inventory balance and purchases in the current period, subtracted by the ending inventory balance.

- Cost of goods sold is the direct cost of producing a good, which includes the cost of the materials and labor used to create the good.

- Businesses may have to file records of COGS differently, depending on their business license.

This means that the inventory value recorded under current assets is the ending inventory. The Internal Revenue Service (IRS) department permits companies to deduct the cost of goods utilised to manufacture or purchase goods that need to be sold to the customers. So, the cost of all such goods is covered under COGS that is showcased as one of the items in the income statement. Therefore, the cost of goods sold under LIFO Method is calculated using the most recent purchases. Whereas the closing inventory is calculated using the cost of the oldest units available. So, to overcome this challenge, various inventory valuation methods are used and the method selected has a great impact on the reported income of your business.

Calculating and reducing COGS is vital for businesses to achieve profitability and maintain a competitive edge. Inventory decreases because, as the product sells, it will take away from your inventory account. For example, a plumber offers plumbing services but may also have inventory on hand to sell, such as spare parts or pipes. To calculate COGS, the plumber has to combine both the cost of labor and the cost of each part involved in the service.

It is allowed to use as per the current accounting standard (IFRS) if the ending value of inventories is not over or under whenever the purchasing price fluctuates. As you can see, Shane sold merchandise costing him $515,000 during the year leaving him with only $35,000 worth of product on December 31. Depending on the COGS classification used, ending inventory costs will obviously differ. For example, if a company has $100 in revenue and $60 in COGS, and the company’s revenue increases to $120, we would expect its COGS to increase to $72 so that COGS / Revenue remains at 60%. You will need to strategically find ways to reduce your costs so that you can improve your profitability. COGS is a key performance indicator (KPI) that tells you how much it costs to produce your product.

The IRS guidelines on COGS allow businesses to include the cost of products or raw materials, direct labor costs involved in production, and factory overhead in their calculations. Every business that sells products, and some that sell services, must record the cost of goods sold for tax purposes. The calculation of COGS is the same for new property tax rebate program all these businesses, even if the method for determining cost (FIFO, LIFO, or average costing method) is different. Businesses may have to file records of COGS differently, depending on their business license. The CRA requires businesses that produce, purchase, or sell merchandise for income to calculate the cost of their inventory.

Since prices tend to go up over time, a company that uses the FIFO method will sell its least expensive products first, which translates to a lower COGS than the COGS recorded under LIFO. An important distinction to note is the difference between COGS and operating expenses (commonly referred to as OpEx). In the Zappos example, while the factory machinery is part of COGS, the electricity, factory supervisor’s salary, and rent are not. While these costs are incurred to generate revenue, they are indirect costs that don’t involve the product itself. Unlike inventory, the COGS appears on the income statement right below the sales revenue. It is subtracted from revenue to calculate Gross Profit, meaning higher COGS means lower gross profit.