Cash Management Using a Cash Disbursements Journal

The payment columns may also be more specific to the nature of the business. For example, some businesses may only need one column to record cash amounts, whereas others may rely on additional columns for accounts payable or discounts received on cash purchases. In any case, there should always be an “other” column to record amounts which do not fit into any of the main categories. This first-hand record will be regularly reconciled to verify if the accounts tally and that there are no mistakes or misappropriations in the books. The reconciliation can be done monthly, weekly, or even daily, depending on the volume of the transactions. It facilitates the easy preparation of financial statements such as income statements, cash flow statements, profit and loss statements, balance sheets, etc.

Special journals

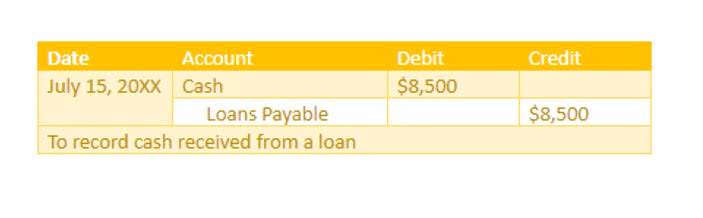

The more details you add to each payment journal entry, the better understanding you’ll have of your cash outflows. When combined, the cash disbursement and cash receipts journals provide a comprehensive view of the business’s cash flow, facilitating the preparation of essential financial statements. The hypothetical scenario showcases how a cash payments journal is crucial in transparent financial reporting and strategic decision-making for TechTech Solutions. Consider the following example for a better understanding of how entries in a cash disbursement journal are made and how the posting to accounts payable subsidiary ledger and general ledger is performed. Besides the above payments, refunds of cash arising from the return of goods by customers are also recorded in the cash disbursements journal. This is a very simplistic example but would show how transactions are recorded.

My Account

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- Post your sales invoice charges from the sales and cash receipts journal to the customer ledgers at the end of each day.

- Transfer debit and credit amounts, the date, and a description of the transaction to your ledger.

- A cash disbursement journal is a record kept by a company’s internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger.

- By maintaining effective credit control, companies can minimize the risk of bad debts and improve cash flow stability.

- Also, it will help quickly detect employee fraud or misappropriation of money.

- He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

- Besides the above payments, refunds of cash arising from the return of goods by customers are also recorded in the cash disbursements journal.

Fact Checked

These transactions encompass outflows, including expenses paid, asset acquisitions, credit payments, and other cash disbursements. QuickBooks Creating journal entries for small business transactions should be like second nature. Read on to get a closer look at recording cash disbursements in your books.

Furthermore, cash disbursement journals can help business owners with cash management by providing clear pictures of inventory expenses, wages, rental costs, and other external expenses. This data can be crucial to making sound business decisions moving forward. Payroll journals, then, are records of all transactions related to employee compensation, including wages, taxes, benefits, and deductions. These journals are used to update the general ledger, which is the master record of all a company’s financial accounts.

- Accrued payroll entries come into play when you have employees who have earned wages during an accounting period, but won’t be paid until the next period.

- Regularly updating and reviewing this report helps maintain accurate financial records, essential for understanding your business’s financial health, budgeting, and auditing.

- This includes checks and electronic funds transfers or any other cash equivalent.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- It is usually easy to pinpoint the error because the debits should equal the credits for each transaction.

- Whether it’s a month, a quarter, or a year, this structured approach to journaling keeps everything spick and span.

19 January 2023 – Purchased a freezer from PQR and paid $5000 via check no. 123. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. These entries are used to correct mistakes, make one-time changes, or record unusual payroll events.

Accounts receivable (often abbreviated A/R) are simply unpaid customer invoices and any other money owed to you by your customers. The sum of all your customer accounts receivable is listed as a current asset on your balance sheet. Whether it’s a month, a quarter, or a year, this structured approach to journaling keeps everything spick and span. It’s not just about documenting transactions – it’s about painting cash disbursement journal is used to record a clear picture of your cash flow journey. A register is a valuable tool for both personal and business banking customers. It is helpful when it comes to keeping track of where the money in a bank account is moving over a given period.